The Blaize Accounting Blog

The Case of the Missing Cash: How I Helped a Small Business Recover Thousands

The Hidden Cost of Poor Bookkeeping Every small business owner knows time is tight, and bookkeeping often takes a backseat to running day-to-day operations. But what if your business is quietly losing money, you don’t even know if it is missing? That’s exactly what I discovered for one client, a hardworking entrepreneur juggling everything from sales to staffing. A simple bookkeeping review turned into a cash flow recovery mission that uncovered thousands of dollars hiding…

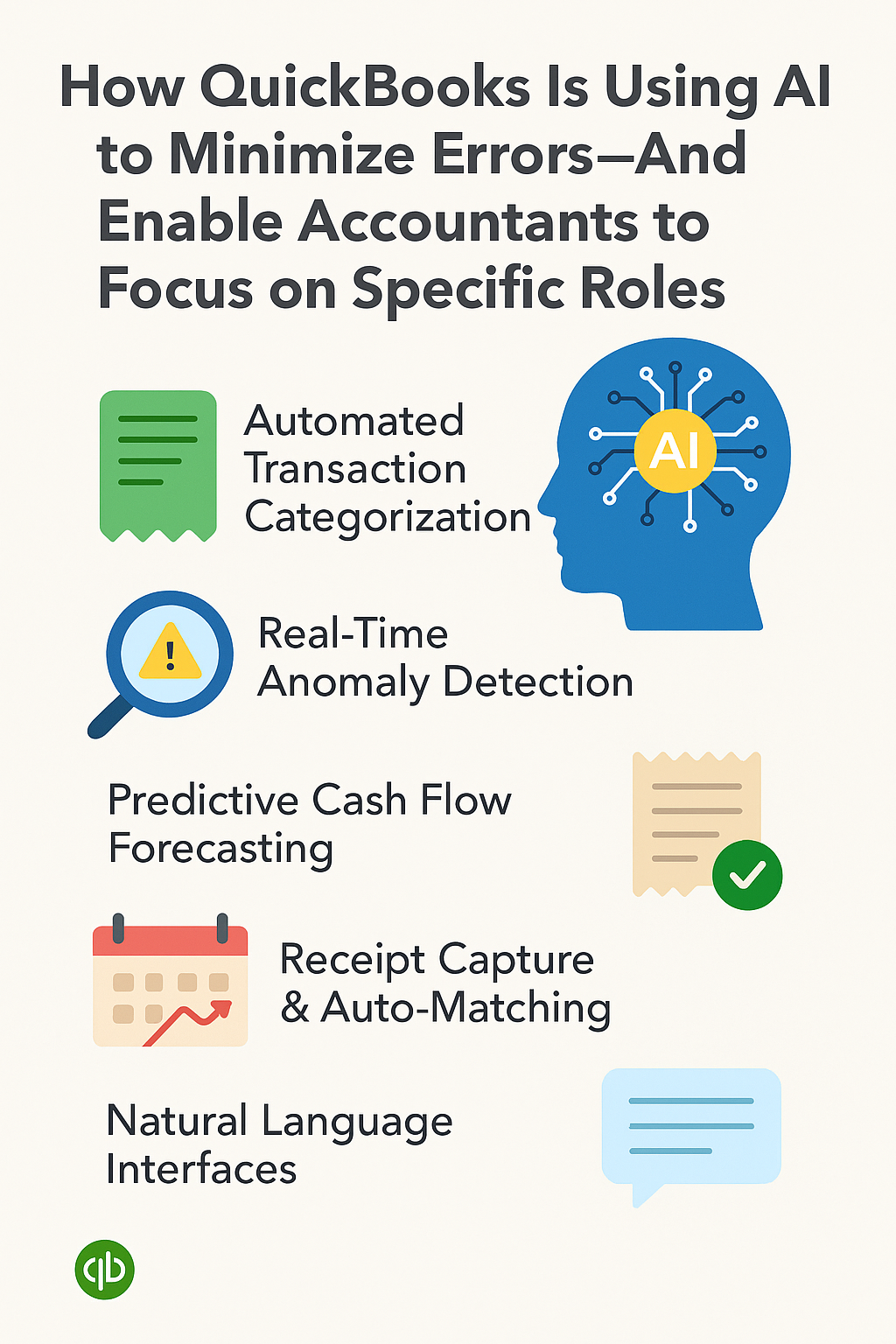

Read MoreHow QuickBooks Is Using AI to Reduce Errors

As a small business owner, your time is valuable, and so is your money. The last thing you need is to spend hours fixing spreadsheet mistakes or chasing down missing receipts. The good news? AI is changing the game inside accounting systems such as QuickBooks, and it’s already working for you. Here is how QuickBooks is quietly using artificial intelligence to make your bookkeeping smarter and your business more efficient: QuickBooks learns from your habits. If…

Read MoreOrganize Your Business Finances this Spring!

Spring is the perfect time to refresh not just your personal space but also your business’s financial health.

Read MoreCatch Up on Bookkeeping Before the Tax Season Closes: Best Practices for Last-Minute Financial Cleanup

Tax season can be stressful, especially if your bookkeeping is not up to date. But don’t worry, there’s still time to get organized and avoid unnecessary stress and potential penalties. Here’s how to efficiently catch up on your financial records before the tax season deadline. Gather all receipts and invoices, both digital and paper. Consider using tools like Expensify or Hubdoc to digitize and organize them in one place. This not only saves time but…

Read MoreYour Ultimate Guide to Stress-Free 1099 Preparation

1099 Preparation Guide

Read MoreActionable Steps Before Year-End: The Power of Automation & Accurate Record-Keeping

In today’s fast-paced business world, staying competitive means embracing the right tools and strategies. Automating financial systems and maintaining accurate records aren’t just operational improvements—they’re game changers. Here’s why: Key Benefits of Financial Automation Time Savings: Automate repetitive tasks like data entry, invoicing, and reconciliations, giving you more time to focus on strategic initiatives. Enhanced Accuracy: Reduce human errors with automated processes, ensuring your financial records are always precise and reliable. Real-Time Insights: Access up-to-date…

Read MoreCredit Card Rewards for Small Businesses

Maximize Your Business Spending with Credit Card Rewards! When used wisely, a business credit card can offer incredible rewards that benefit your bottom line. Here’s what some credit card companies are offering: Cash Back on Purchases – Earn back a percentage on everyday expenses, from office supplies to fuel. Travel Perks – If you or your team is on the road often, find a card with travel rewards like miles or hotel points to reduce expenses. Sign-Up Bonuses – Many…

Read MoreAre you Thinking About Opening a Business Bank Account? Look Out for These Incentives!

Banks compete for your business, and many offer fantastic perks when you open a new business account. Here are some incentives that you could gain: Cash Bonuses – Some banks offer up to hundreds of dollars just for signing up and meeting a minimum deposit requirement.🆓 Fee Waivers – Enjoy reduced or waived fees on services like monthly maintenance, wire transfers, or overdrafts. Business Tools & Support – Access to specialized business tools or consultations can be a…

Read MoreThe Difference Between a Bookkeeper and an Accountant

One area that often creates confusion in financial management is determining the difference between the role of a bookkeeper and an accountant. You might wonder, “Do I need a bookkeeper, an accountant, or both?” Understanding the distinct roles of these financial professionals can help you make informed decisions and keep your business running smoothly. Let’s break down the differences. The Role of a Bookkeeper A bookkeeper is like the diligent librarian of your business’s financial…

Read More