One area that often creates confusion in financial management is determining the difference between the role of a bookkeeper and an accountant. You might wonder, “Do I need a bookkeeper, an accountant, or both?” Understanding the distinct roles of these financial professionals can help you make informed decisions and keep your business running smoothly. Let’s break down the differences.

The Role of a Bookkeeper

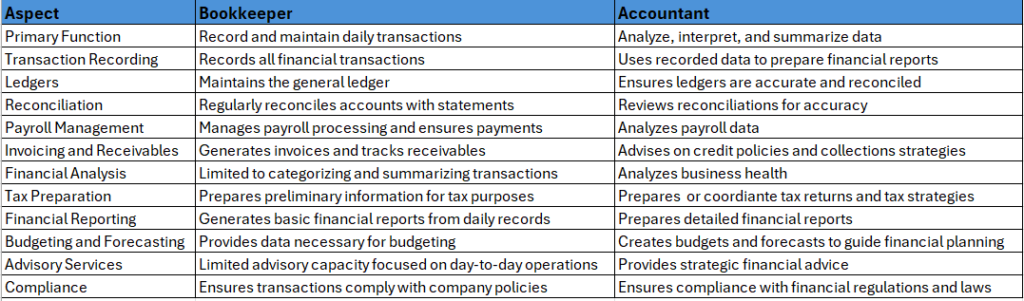

A bookkeeper is like the diligent librarian of your business’s financial library. Their primary role is to record daily financial transactions accurately and systematically.

The Role of an Accountant

Accountants take the foundational work done by bookkeepers and analyze, interpret, and summarize it. Their role is more strategic, providing insights and recommendations to help you make informed financial decisions.

Do You Need Both?

Both bookkeepers and accountants play crucial roles in managing your business’s finances, but their functions complement each other. Bookkeepers ensure that your financial data is accurate and up to date, while accountants use that data to provide insights and strategic advice.

For small businesses, having both professionals can be particularly beneficial. The bookkeeper handles the day-to-day financial tasks, allowing you to focus on running your business. Meanwhile, the accountant provides financial planning, analysis, and long-term growth expertise.

Understanding the difference between a bookkeeper and an accountant is key to optimizing your business’s financial management. Each role serves a unique purpose, and together, they create a comprehensive financial support system. By leveraging both strengths, you can ensure that your business’s finances are in order and strategically positioned for growth.

Ready to streamline your financial management and take your business to the next level? Let’s discuss how our bookkeeping and accounting services can support your goals. Reach out today!