Accounting

The Case of the Missing Cash: How I Helped a Small Business Recover Thousands

The Hidden Cost of Poor Bookkeeping Every small business owner knows time is tight, and bookkeeping often takes a backseat to running day-to-day operations. But what if your business is quietly losing money, you don’t even know if it is missing? That’s exactly what I discovered for one client, a hardworking entrepreneur juggling everything from…

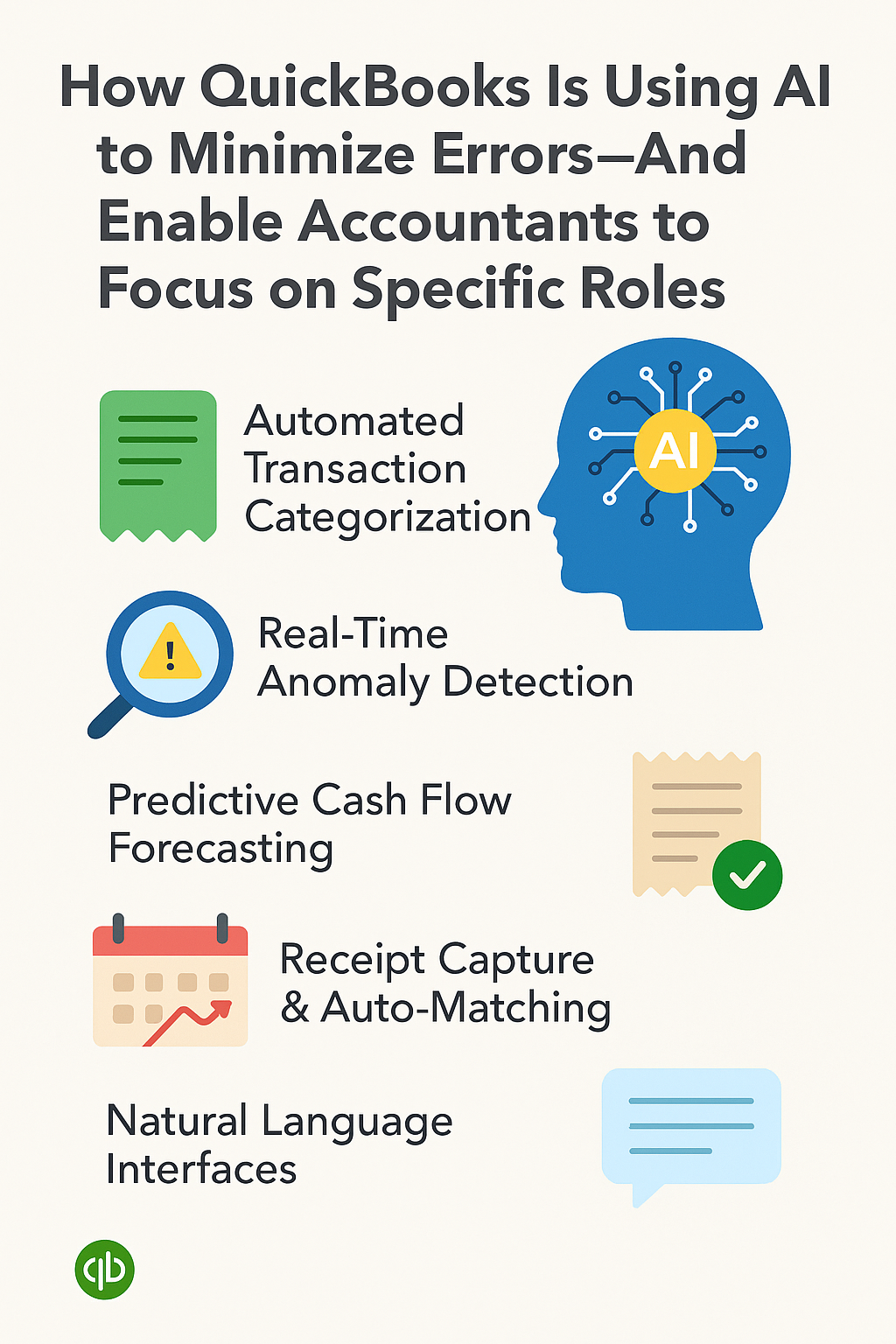

Read MoreHow QuickBooks Is Using AI to Reduce Errors

As a small business owner, your time is valuable, and so is your money. The last thing you need is to spend hours fixing spreadsheet mistakes or chasing down missing receipts. The good news? AI is changing the game inside accounting systems such as QuickBooks, and it’s already working for you. Here is how QuickBooks is…

Read MoreOrganize Your Business Finances this Spring!

Spring is the perfect time to refresh not just your personal space but also your business’s financial health.

Read MoreYour Ultimate Guide to Stress-Free 1099 Preparation

1099 Preparation Guide

Read MoreActionable Steps Before Year-End: The Power of Automation & Accurate Record-Keeping

In today’s fast-paced business world, staying competitive means embracing the right tools and strategies. Automating financial systems and maintaining accurate records aren’t just operational improvements—they’re game changers. Here’s why: Key Benefits of Financial Automation Time Savings: Automate repetitive tasks like data entry, invoicing, and reconciliations, giving you more time to focus on strategic initiatives. Enhanced…

Read MoreCredit Card Rewards for Small Businesses

Maximize Your Business Spending with Credit Card Rewards! When used wisely, a business credit card can offer incredible rewards that benefit your bottom line. Here’s what some credit card companies are offering: Cash Back on Purchases – Earn back a percentage on everyday expenses, from office supplies to fuel. Travel Perks – If you or your team is…

Read MoreAre you Thinking About Opening a Business Bank Account? Look Out for These Incentives!

Banks compete for your business, and many offer fantastic perks when you open a new business account. Here are some incentives that you could gain: Cash Bonuses – Some banks offer up to hundreds of dollars just for signing up and meeting a minimum deposit requirement.🆓 Fee Waivers – Enjoy reduced or waived fees on services…

Read MoreThe Difference Between a Bookkeeper and an Accountant

One area that often creates confusion in financial management is determining the difference between the role of a bookkeeper and an accountant. You might wonder, “Do I need a bookkeeper, an accountant, or both?” Understanding the distinct roles of these financial professionals can help you make informed decisions and keep your business running smoothly. Let’s…

Read MoreThe Importance of Regularly Updating Your Financial Plan

Creating a financial plan is a critical step for any business, but it doesn’t end there. The business environment is dynamic, and your financial plan should be too. Regularly revisiting and updating your financial plan is essential to ensure it remains relevant and effective. Keeping your financial plan current is crucial for your business’s success,…

Read MoreThe Cost of Not Having a Business Financial Plan

As a small business owner, you understand the importance of making informed financial decisions. However, many entrepreneurs overlook the critical step of creating and maintaining a comprehensive financial plan. The cost of neglecting this essential tool can be substantial, affecting your business’s growth, profitability, and long-term sustainability. Let’s explore the significant costs associated with not…

Read More